Buy a Fixer-Upper with a Rehabilitation Lending in NH.

All FHA borrowers pay ahead of time home loan insurance coverage, regardless of just how much home equity they have or http://arthurgigz660.jigsy.com/entries/general/can-i-switch-over-nursing-houses-under-medicare- the dimension of their deposit, which increases the size of the month-to-month settlement. Yearly mortgage insurance is also needed for consumers who make a down payment of much less than 20% or have a loan-to-value of 78% or even more. Depending on the size of your job, these charges average a total amount of $500 to $800. 203K Streamline Finance, likewise called the FHA 203k mortgage program is made to assist Pennsylvania residence customers (and also home owners) purchase and also consist of rehabilitation (or fixing) prices in one home loan.

What banks offer rehab loans?

Yes! You can finance repairs needed to pass an FHA inspection or desired repairs done by a professional. If there are DIY home improvements you want to tackle, simply don't roll them into the bids for the work with the sti testing deerfield beach FHA 203k.

This frees up additional funds for repair services and improvement jobs, and also even permits as much as six months of home loan repayments to be rolled into the financing. This is especially valuable if the building can't be occupied during building and construction, which could cause homebuyers to need to increase up on their real estate expenses till the work is done. The Federal Housing Management (FHA) developed the 203( k) program in order to motivate the acquisition of properties in demand of fixing, and the restoration of existing residential or commercial properties. An FHA 203( k) rehabilitation car loan can be made use of to buy or refinance a house and also include the costs of restoring the building in a single mortgage transaction.

What is the maximum amount for a 203k loan?

$0 is the minimum and $35,000 is the maximum. The Limited program is not constrained by FHA county loan limits. The following costs can be included in the Limited 203k loan amount, assuming the $35,000 cap is not exceeded: Total cost of rehabilitation.

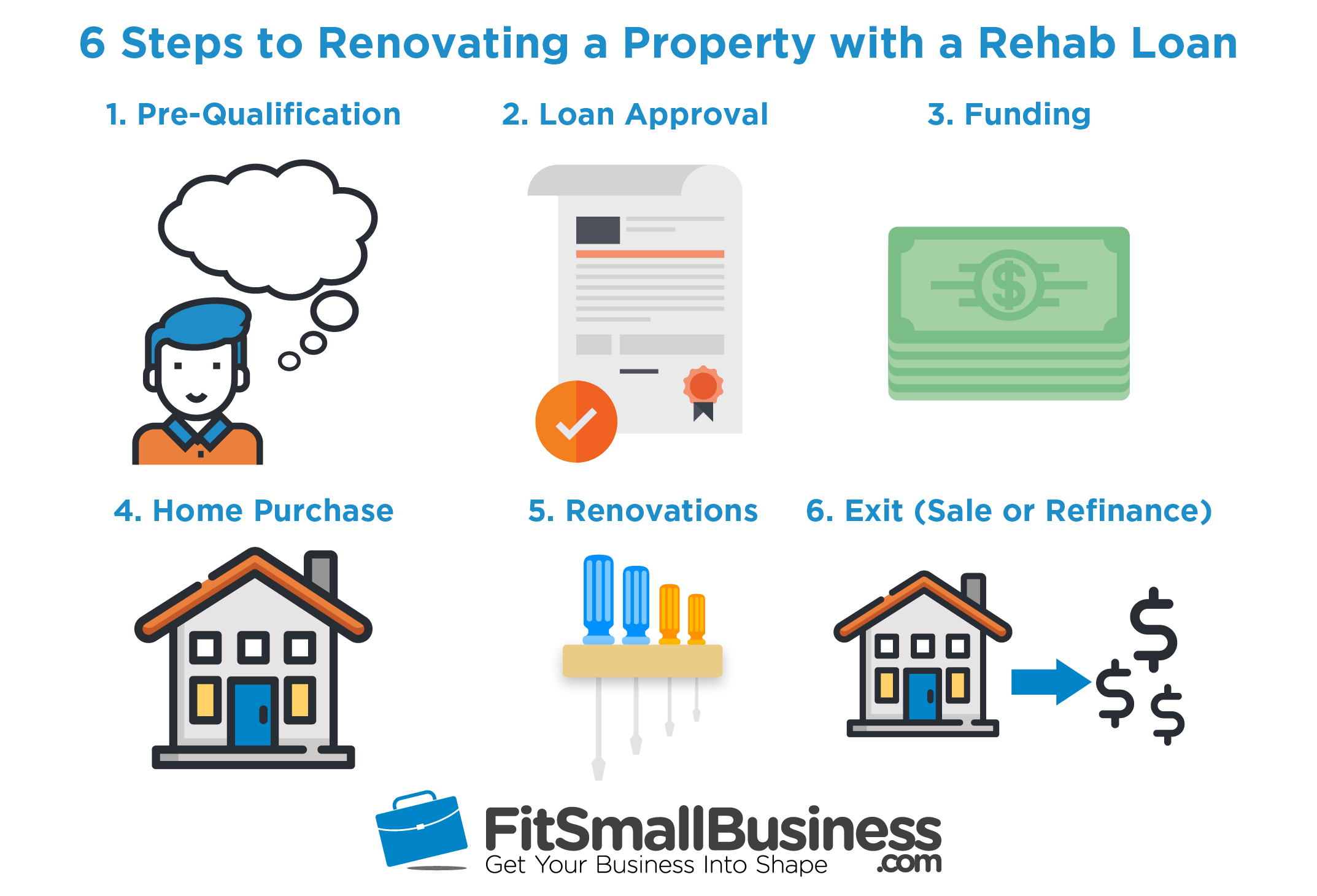

You'll begin on a familiar path when starting the 203k home loan process. Initially, you'll meet a 203k approved lending institution to obtain home mortgage pre-approval. You'll function with a genuine estate agent to situate an eligible residential or commercial property once that is safe. Given that the financing includes rehab costs, you must include a detailed list of repair work that will certainly need to be made and the price for every fixing.

What does a rehab loan cover?

Rehab loans are designed to help homeowners improve their existing home or buy a home that can benefit from upgrades, repairs, or renovations. A 203(k) rehab loan is a great way to help you create your own home equity fast by bringing your home up to date.

- We were able to re-finance out of the FHA funding a couple years later, right into a convention funding as well as likewise out of PMI given that our enhancements increased our equity by greater than 20%.

- In some cases called a Rehab Car loan or FHA Building Funding, a 203k car loan enables you to refinance your home and also needed repair work.

- To receive a 203k financing, you'll need to satisfy the same property, credit history as well as debt-to-income ratio demands as any type of other FHA financing.

- The federal government backs these loan providers as well as lendings track and also validate repairs at key points in the process.

- Be prepared to pay additional money for PMI.PMI (exclusive home loan insurance) is an added plan that you pay for on a finance, when you take down less than 20% down.

All FHA loans, including 203k lendings, call for mortgage insurance policy. You'll pay a 1.75% costs in advance on closing day, plus an annual costs. The annual premium depends upon your loan equilibrium and is spread out across your month-to-month settlements.

How do you qualify for a rehab loan?

The lender funds the loan. Part of the loan funds are put into an escrow account, which holds the money for the repairs. 50% of the repair costs are issued to the contractor up front. The other 50% will be paid to the contractor when all work is complete.

To receive a 203k lending, you'll require to satisfy the exact same asset, debt as well as debt-to-income ratio needs as any other west palm beach fl drug rehab treatment FHA funding. Since the loan is based on the value of a residence after renovations, as opposed to previously, your equity and the quantity you can borrow are both higher. Be prepared to pay extra money for PMI.PMI (private home mortgage insurance policy) is an added policy that you spend for on a financing, when you put down much less than 20% down.

Streamline 203k Program Summary

Moreover, if you have solid credit rating, your regular monthly home mortgage insurance becomes more affordable. Finally, you can cancel your home loan insurance when you get to 22% house equity. That being said, lots of lending institutions need a minimal rating over 600 to qualify for a 203k financing. Nevertheless, it is a lot less than the 720+ credit rating needed for a lot of traditional building financings. The FHA's minimal 203k rehabilitation lending program permits homebuyers as well as home owners to fund approximately $35,000 of their home loan to repair, boost, or otherwise upgrade their house.

Do you need a downpayment for a rehab loan?

Down payment: The minimum down payment for a 203(k) loan is 3.5% if your credit score is 580 or higher. You'll have to put down 10% if your credit score is between 500 and 579. Down payment assistance may be available through state home buyer programs, and monetary gifts from friends and family are permitted as well.